passionate about ethical values

What is an Ethical Fund? 20 questions – and answers!

What is an Ethical Fund?

It is termed an Ethical Fund, because the companies that it invests in have been through an ethical screening process. Usually the fund will be a Unit Trust or an OEIC which are also known as a ‘collective investments’.

What is a ‘collective investment?’

It is a collection of shares in different companies held within one fund (the unit trust or OEIC). Collective investment provides the opportunity for people with smaller amounts of money to invest in a wide range of different companies and asset classes at a lower cost than investing directly in the stock market as the costs are shared with other investors.

How many ethical funds are there to invest in?

There are approximately 60 ethical funds at the moment, but this can vary from time to time.

How many different companies does an ethical fund hold?

It can vary from about 30 to 200, but generally speaking it will hold in the region of 60 to 70 different company shares.

Why does it hold so many companies in the one fund?

The spread across a wider number of companies, provides investment diversification which reduces investment risk. Studies have shown that the optimum number of holdings is 60 to 70 to minimise risk and that holding more, does not necessarily reduce the risk further.

Why is it likely to be less expensive to invest in collectives than in direct stocks and shares?

The economies of scale come into play here, as the dealing charges (charges for buying or selling a stock) tend to be a fixed charge, regardless of the amount of the transaction.

As the dealing charges for unit trusts and OEICs are split between all of the unit holders, the actual cost is minimal to the individual investor, whereas if you had your own portfolio, you would have to bear the full charge yourself.

Can I choose what companies are held in my fund?

Can I choose what companies are held in my fund?

Unfortunately not, but we can help you choose funds that are suited to your ethical principles. For larger sums of money, you have the option to select individual stocks that meet your personal criteria, but generally it is not cost effective for you to hold a stocks and shares account with smaller sums of money.

Are all ethical screening processes the same?

No, different fund managers use different ethical screens it depends on the remit of the fund and some screens are more strict than others. As an example all ethical funds screen out arms and tobacco, some companies screen out animal testing, some screen out banks.

Some companies outsource the first level of ethical screening to a specialist service such as EIRIS who is an independent organisation. Very often there are at least two separate levels of screening and many investment companies also have their own in-house research team.

Do all of the funds have the same investment risk?

No, there are ethical funds in most financial sectors, we can choose the most suitable ones for your risk profile and we can also put together a portfolio of ethical funds from different sectors to get the risk balance that suits your attitude to risk.

Are ethical funds higher risk than mainstream funds?

In the past, there was a higher level of risk with ethical funds due to the limited stocks available for investment, these were generally equities, but the industry has developed over the years and now there is a much wider selection of funds covering all asset classes and risk profiles. So, no providing you are invested in the funds that suit your risk profile, which is the same for mainstream investment.

Are all of the investments in the UK?

There are quite a few UK ethical funds, but there are many global and European ethical funds. There are also emerging market funds for example the ‘BRIC’ countries, Brazil, Russia, India and China. Although these funds tend to be higher risk, they are often included in a portfolio in smaller proportions to provide exposure to these markets.

What kind of areas can I invest in?

There are approximately 60 different ethically screened funds to choose from. Some are generalist funds, so they are invested in most sectors, as with their non-ethical counterparts – but they do not hold the sin stocks! These are screened out.

There are also ‘thematic’ funds, the key is in the name, so these may be invested one particular industry for example renewable energy or water purification, sustainable forestry, recycling etc.

Can I hold them in my pension or ISA?

Yes, in fact most pension funds today are made up unit trusts and OEICs, only the older pension arrangements have the old traditional with profits funds.

You can invest your full ISA allowance in unit trusts and OEICs or if you wish to keep the Cash component separate, then you can just invest in unit trusts and OEICs in the equity component.

How do I decide which funds to choose?

It would be advisable to have some help with this from a financial adviser who specialises in ethical investment. Most ethical funds may seem ethical, but as most ethical advisers work closely with the ethical fund managers, they know which ones are truly ethical and which ones are just ‘window dressing’. We would be able to help you with this. We regularly review the fund’s stock holdings, performance and charges to make sure that the funds are doing what they say they do.

Who checks the companies that are held in the funds?

The fund manager and his research team regularly review the holdings in their fund. They meet with the companies that they invest in, known as ‘engagement’, to discuss any issues or questions that may have been raised by the team.

It is regular practice for the fund manager to attend the company’s board meetings or AGM.

Often a client may raise a question as a result of learning about an issue in the media and we will follow this up with the fund manager.

How do the returns compare with mainstream funds?

Ethical funds perform more or less on a par with mainstream funds. There will always be exceptions, for example the dramatic falls of 2008, in this instance although the ethical funds in the main did not fare any worse than the mainstream funds, they were slightly slower to recover. This was mainly due to lack of exposure to the banking industry, tobacco and oil!

The variance now is minimal and can easily be seen from fund performance statistics.

How do the charges compare with mainstream funds?

The charges are generally the same, there is no distinction between ethical and mainstream – although the ethical investor is getting additional value from the ethical screening of the stocks for no extra charge.

Which are the top performing ethical funds?

There will always be top-performing funds, but in reality, it is rare for a fund either ethical or mainstream to remain in pole position for a prolonged period, it is therefore important to select funds that can provide consistent performance, rather than chase the current leaders.

What should I do if my question has not been answered here?

What should I do if my question has not been answered here?

If you need help on Ethical Funds, call me, Kathy Booth or my partner Nick Abbott we would be happy to help! Kathy – 07795 662855 Nick – 07919 621109

Pension or isa?

Should I save in a Pension plan or in ISAs for my retirement?

Well, ideally in a perfect world – both

This is a question we are often asked. I hope that the following information is helpful, basically the sooner you start to save the better!

Pension contributions

Generally – when you make a pension contribution, your contribution receives tax relief at your highest marginal rate and your pension fund grows in a tax efficient environment, (although not completely tax free). When you come to take your retirement benefits from your pension fund, usually 25% of the fund can be taken as a tax free lump sum and the remaining 75% will provide an income which is taxable.

So the advantage of a pension plan is that you receive a significant tax advantage on the contributions and the fund grows virtually free of tax.

ISAs

On the other hand – An ISA does not receive the tax relief on the amount invested, but it does also grow in a tax efficient environment. When you take your money from your ISA, the whole amount is paid to you without any tax being due.

Conclusion

Broadly speaking, the Pension and the ISA have similar tax advantages in monetry terms but completely different structures, so a combination of the two could be a useful retirement planning tool.

Imagine that the pension and the ISA were balanced on the two opposite sides of a set of scales.

And with careful investment planning for retirement you have balanced your savings across the scales.

Under current legislation, this has the potential to allow you to control the flow of your income in retirement from one side or the other in order to minimise the tax that you will pay on this income.

Most importantly – you should always take professional financial advice before making important decisions such as planning and saving for retirement. The legislation relating to pensions in particular, is constantly changing and you need to keep abreast of the changes. The above example is not a recommendation, purely thought provoking – I hope.

Please remember – Retirement planning should be a long term commitment – don’t delay.

Contact us for advice with YOUR RETIREMENT planning, we would be pleased to help.

What is a unit trust?

What is a Unit Trust?

If you know the answer to this, you probably also know that the Pension plans, ISAs and Investment Bonds that you hold are invested in Unit Trusts.

However, surprisingly there are many people in the UK who do hold Pensions, ISAs and Investment Bonds, but are unaware that they have invested in Unit Trusts through their savings and investment plans.

Types of Unit Trust

There are thousands of Unit Trusts available in the UK that invest in different geographical sectors and asset classes.

We have listed the main asset classes below, in what the financial industry considers to be the investment risk order, however the stock-market fluctuates on a daily basis and current global and economic events affect the different asset classes in differing ways.

Mains asset classes:

- Fixed interest, e.g. banks and building societies

- Gilts, which are loans to the government, they can be indexed with inflation

- Corporate Bonds, these are loans to companies, which are graded dependant on the risk of default from AAA which have the least level of default risk, down to EEE which have the highest level of default risk. The higher the risk the higher the amount of interest will be charged to the borrower. Most Corporate Bond fund managers only lend to companies rated from AAA to CCC, with the majority of the lending to the A and B categories.

- Commercial Property, some is invested in actual property i.e. bricks and mortar, some are invested in property shares and some are a hybrid of the two, they can be in properties in the UK or overseas

- Equities, these are invested in direct shares in the stock-market, they can be in UK companies or overseas companies or a combination of the two

An Equity Unit Trust will hold a wide selection of holdings in many different companies, ranging from approximately 30 companies to 200 companies. This means that if you invested £1,000 in a particular Unit Trust, your investment would be split across a wide range of companies within the Unit Trust in the proportions chosen by the fund manager.

There are usually a much lower number of holdings in Fixed Interest, Corporate Bond, Gilt and Property Funds.

The diversification of the holdings held within each Unit Trust is designed to reduce the risk and volatility of the fund.

A Unit Trust is an ideal way of investing amounts of money in a diversified portfolio of holdings whilst minimising dealing charges. Another name for a Unit Trust is a Collective investment.

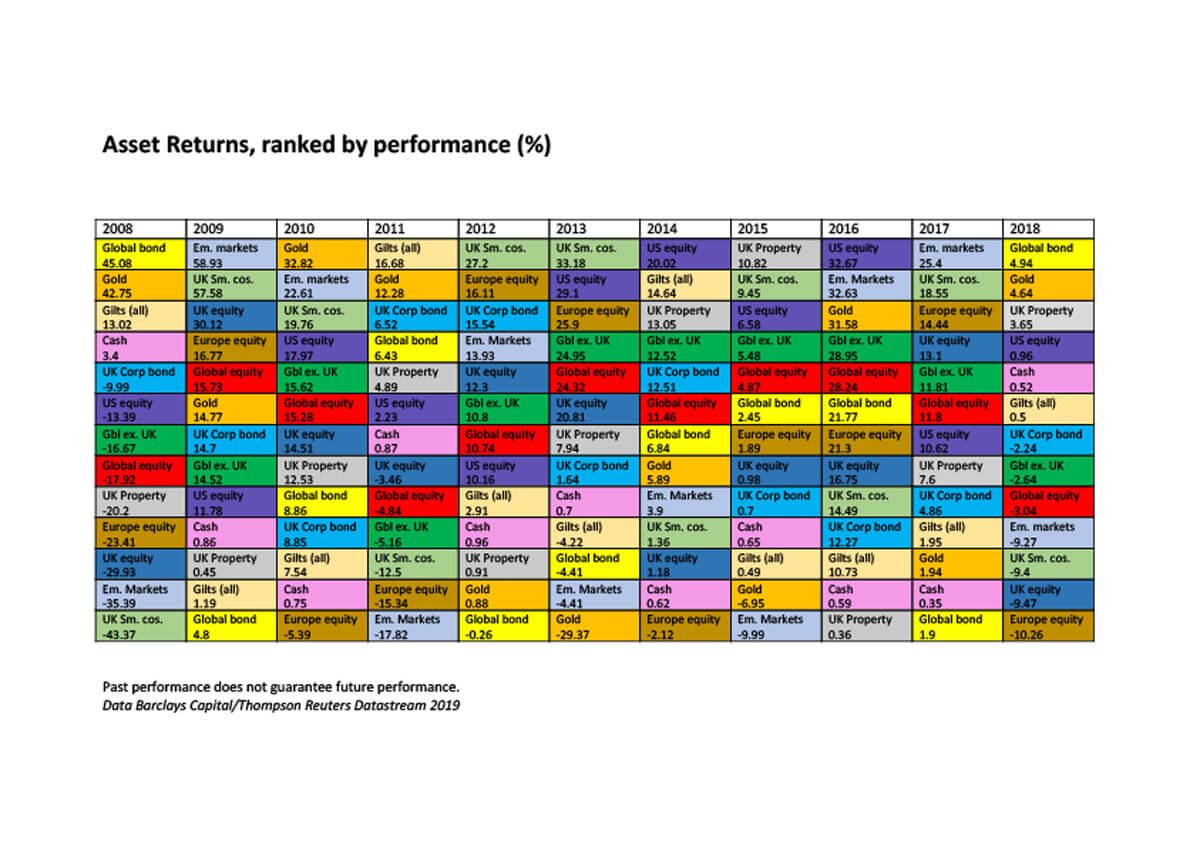

The asset performance chart above summarises the best and worst performing assets classes over a 10 year period. The best performers are at the top of the chart and the worst are at the bottom. Source: Barclays Capital/Thompson Reuters Datastream 2019. It is clear from the chart that every year there are winners and losers, therefore most people would be well advised to invest in a diversified asset portfolio. There is no strict rule to this as it will depend on your appetite for investment risk, your personal circumstances and your needs and objectives both now and in the future.

If you would like to print a larger version,(one that you can read) just double click on the table.

Very often a particular Unit Trust will be available for investment in Pensions, ISAs and Investment Bonds, or on a stand-alone basis, therefore it is important not just to have the most suitable portfolio of Unit Trusts, but also to select the most suitable investment vehicle.

Please note that before making any investment decision, you should consult a professional financial adviser. The information provided is not a recommendation, it is purely to give an insight into one of the major investment vehicles in the UK.

Contact Us

See how we can be of help to you or your business